Field Service Management

Re-imagined

Four Tenets of

A macro focus to disrupt the entire industry. While everyone is addressing individual touch-points in the

Field Service Management sector, i4T Global connects the dots between all stakeholders to deliver customer experience, value and information that truly matters to everyone.

A macro focus to disrupt the entire industry. While everyone is addressing individual touch-points in the

Field Service Management sector,

i4T Global connects the dots between all stakeholders to deliver customer experience, value and information that truly matters to everyone.

Efficiency

Fast, simple and complete access to every information, in the office or on the go. Ensuring more freedom and flexibility to work efficiently in the field and deliver a better service.

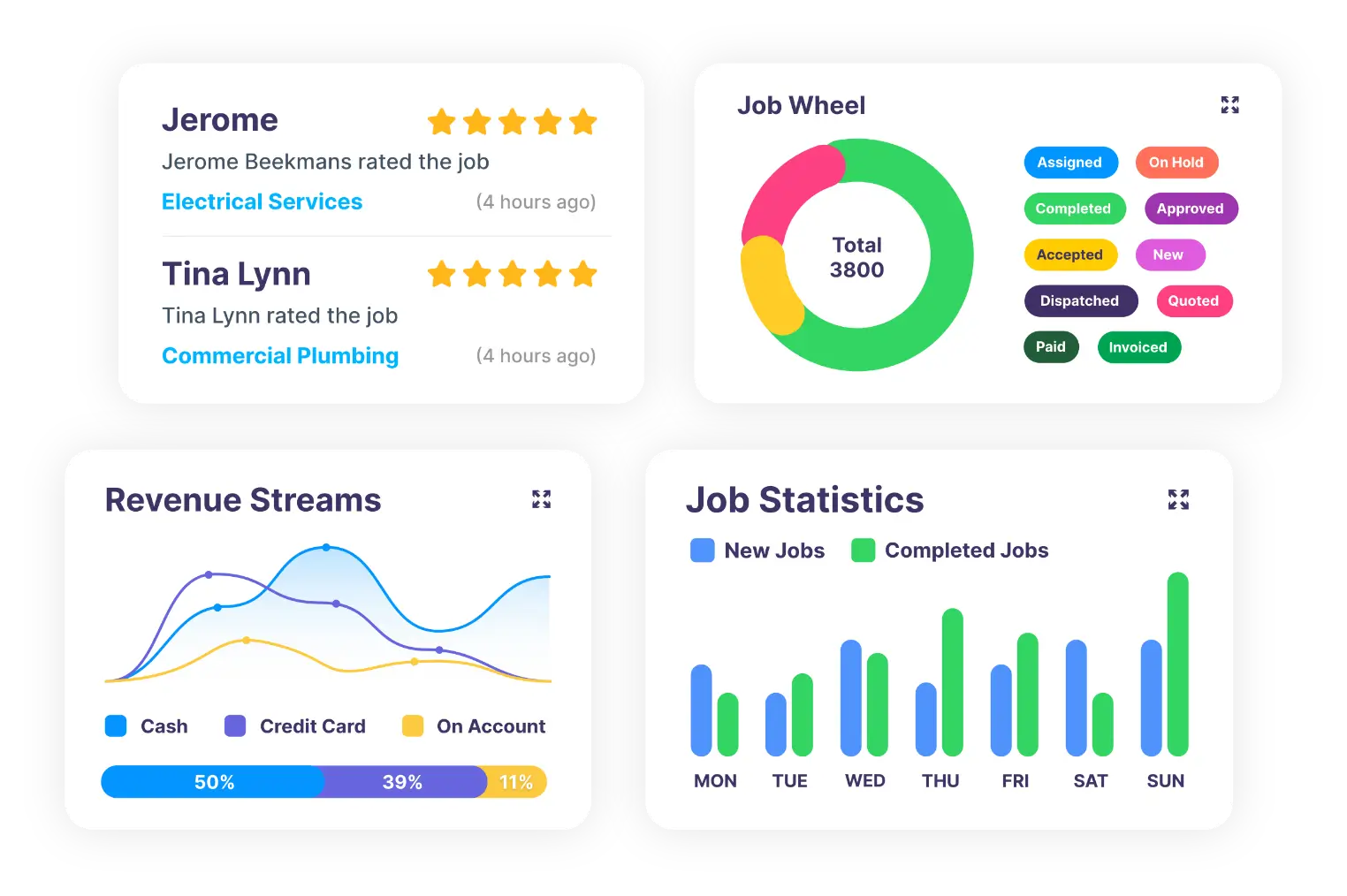

Transparency

Complete visibility into all aspects of Field Service Delivery from receiving quotes, scheduling, dispatching and invoicing with open communication between all stakeholders.

Compliance

Automated insurance, license registration and

on-site OHS compliance requirements of the

Field Service Supplier in line with Local Government regulations.

Safety

Licensed and Insured

Field Service Suppliers delivering peace of mind for Authorized Service Agents and Asset Owners & Occupants.

Efficiency

Fast, simple and complete access to every information, in the office or on the go. Ensuring more freedom and flexibility to work efficiently in the field and deliver a better service.

Transparency

Complete visibility into all aspects of Field Service Delivery from receiving quotes, scheduling, dispatching and invoicing with open communication between all stakeholders.

Compliance

Automated insurance, license registration and on-site

OHS compliance requirements of the Field Service Supplier in line with Local Government regulations.

Safety

Licensed and Insured

Field Service Suppliers delivering peace of mind for Authorized Service Agents and Asset Owners & Occupants.

Empowering a Diverse Range of Industries

Achieve operational excellence and deliver a remarkable customer experience,

with solutions tailored to your industry-specific needs.

Seamlessly Innovative Integrated Ecosystem

Every Touch Point in the

Field Service Management Sector is

Connected

Innovative, efficient, and tech-driven model connecting the dots between Authorized Service Agents, Field Service Suppliers, and Asset Owners & Occupants to eliminate the hiccups in Field Service Management and deliver one seamless experience across all verticals.

Innovative, efficient, and tech-driven model connecting the dots between

Authorized Service Agents,

Field Service Suppliers, and Asset Owners & Occupants to eliminate the hiccups in Field Service Management and deliver one seamless experience across all verticals.

Reviews That Speak Volumes

A Spotlight on Our Satisfied Customers

A great solution is more than just tech

A great solution is more than

just tech

in Action

At i4T Global, we put customer experience, left, right, and center! As an FSM ecosystem, we don’t just iterate new features, but also develop procedures that ensure our teams and products grow with you helping us build meaningful relationships with our customers.

At i4T Global, we put customer experience, left, right, and center! As an FSM ecosystem, we don’t just iterate new features, but also develop procedures that ensure our teams and products grow with you helping us build meaningful relationships with our customers.

Ready to get started ?

for your business too!